Thanks to media coverage worthy of a royal wedding, everyone now knows that Apple’s balance sheet looks better than the U.S. government.

Not exactly an earth-shattering revelation – and Steve Jobs didn’t get married – so why all the fuss.

Reverse engineering the hoopla illustrates the storytelling that can come out of a single dot-connecting moment.

First, look at Apple’s Q2 quarterly earnings which always trigger a spike of media coverage.

A Google search on Apple + Q2 + earnings covering April 19/20 results in 415 hits.

A Google search on Apple + Q3 + earnings covering July 20/21 results in 357 hits.

Even though the Q3 numbers revealed all-time record revenue and earnings, the media coverage was actually less than Q2.

The Apple 10-Q included the cash hoard but few picked up on this even though it jumped a whopping $10 billion from the previous quarter.

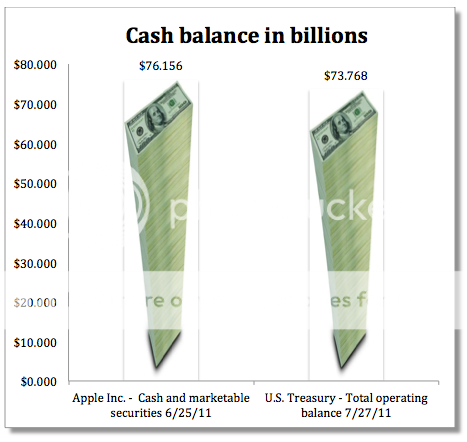

The market intelligence site Asymco was one of the few, publishing the following chart on July 20 when Apple announced Q3 earnings (Apple watchers should bookmark this site).

I think the time has come for Apple to offer unlimited organic trail mix to all employees.

O.K., that’s the Apple piece.

Turning attention to U.S. Treasury Department-

The organization issues an operational statement on a daily basis which rarely generates attention. Looking at the closing balances on these Treasury statements last week, nothing jumps off the page.

Yet, when Matt Hartley at the Financial Post pens the piece “U.S. balance now less than Apple cash,” virtually every media property in the free world – and some not in the free world; Tehran Times picked up the story -jumps on the bandwagon.

Hartley leads with the punch line:

Steve Jobs is now more liquid than Uncle Sam.

then nicely milks the juxtaposition:

While it’s highly unlikely that President Barack Obama is looking to ask the founder and chief executive of Apple Inc. for a loan, it became a fact as of Thursday afternoon — the world’s largest technology company now has more cash on hand than the most powerful democracy on Earth has spending room.

Think of it as “mashup storytelling.”

By connecting two disparate piece of information, the amusement quotient dramatically increases.

Which causes the story to be repeated again and again under varied maskheads … often with zero credit or backlink to the Financial Post story (hello CNN).

Even Fortune, which inaccurately credits The Atlantic, can’t resist with the only original thinking coming in the form of the graphic.

Colleague Merredith Branscome from LeapPR notes “Apple’s out$ized profit + DC’s miniscule margin for error made for a perfect storm.”

I agree but also believe companies don’t need a perfect storm to apply the same “mashup storytelling” to their own communications.

Thinking like a journalist, the trick lies in contrasting and connecting your own information to something from the outside world with the end result being fresh context. As we saw in the Financial Post story, this type of insight tends to get “borrowed” by others.

BTW, the “Apple has more dough than the U.S. government” story could have just as easily been written on July 14 since Apple’s Q2 cash exceeded the government’s operating cash balance on this day too.